By Bane

This post was written on July 5, 2020.

There wasn’t much action in the markets on a shortened week due to Canada Day and US Independence Day. However there was some important action in the macro environment.

Jobs Matter

In the UK there were more than a few retailers and restaurants announcing job cuts with the end of government schemes on the horizon. If businesses are already anticipating the need to make job cuts as the UK comes out of lockdown, that does not bode well if demand does not reach pre-March levels quickly.

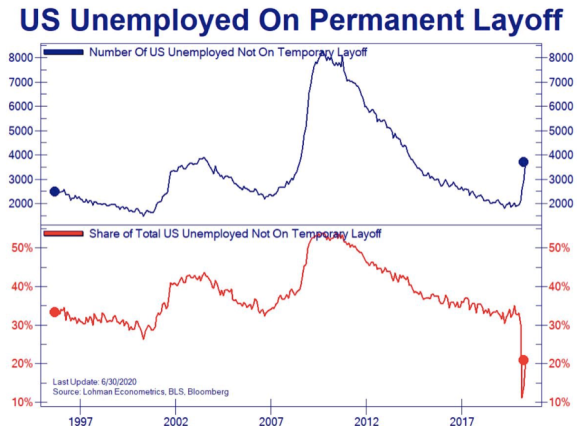

In the US many have been noting the trend towards permanent layoffs as more apparent. Temporary layoffs have to turn back into regular employment, which is only possible with a “v-shaped” type of recovery. Anything less and so many small businesses can not survive. Going months bleeding cash only to have a fraction of your pre-Covid customer base return, while being heavier in-debt, is not going to create a situation where jobs stabilise.

In the UK, the big companies that are heavily in-debt, in retail or hospitality, have been careful until now about layoffs (and will continue to be so), but they will have to make them at some point. There is a reputation angle they must be mindful towards. Larger corporate layoffs announced in the UK last week arrived on the same day, with helped to lesson the headlines of any one company. SSP and easyJet’s announcements account for over 10% of its employee count. These are not small cuts.

Yet the day of the UK job cuts, its main index was up over 1%.

Gold Matters

Gold charts that make you think, give you some perspective. The first one, if you price the Dow in Gold the performance does not look so great for the Dow.

The Dow has yet to reach 2000 levels relative to Gold.

The below chart says a lot more. There is a long period in which to own the S&P 500, or gold. I haven’t run the numbers but these trends put forth a method of removing all the noise. Own the index or own gold. You would have done well switching back and forth, even if you were a bit late to the party each time. The trends are medium to long term (depending how you define that for yourself). Which also helps minimise transaction costs.

![]()

GeoPolitics Matter

China made a move. We try to avoid politics here as much as possible, since the subject has become way too toxic in today’s era (too bi-polar, too binary, too emotional). So instead of getting into the political fray, here’s an interview with someone who has spent a little time in China and shares some views on its “business practices” and “invest-ability”. It helps to start by listening to those that have been on the ground and don’t have a direct or indirect financial interest in China’s economic power ascending. I’m talking to you HSBC and Standard Chartered. Investor’s Chronicle and it’s value investing small-cap recommendations list got bit at least once that I can recall by the Chinafraud bug (sorry, can’t find the link but they admitted as much in their most recent podcast). Don’t let it be you next. You’ve been warned.

Other Notes

I wasn’t sure if this was a joke or not. I understand Tesla is trying to create a brand. It’s just that the cult following of this company is a bit too much sometimes. It reminds me of so many failures in the past. I will have to leave it for another post, but I remember my first encounter with a Muskennial.

John Paulson, made a legend by the 2008 financial crisis, has gone meekly into that good night. He will also open up a family office. It is a reminder for anyone wanting to manage money for external clients (even your in-laws – be careful), how painful that job is when you underperform. The rage is all for family offices now. Ten-fold increase in these opaque institutions since the financial crisis. It is correlating with a rise in “impact investment”, of which we have something to say, but not today.