By Bane

This post was written on July 12, 2020.

The week that was continued themes that have been on-going for several weeks. American indices were up, with the NASDAQ up big, while the UK’s FTSE was down for the week along with other major European indices. Certain beloved tech stocks continued to outperform, some to amazing levels. Meanwhile, Gold breached the $1,800 level. COVID problems continue to mount in the US and uncertainty continues to prevail, but you wouldn’t know that looking at the markets.

I Give Up

Markets are still insane. In the past week:

The NASDAQ reached all-time highs and Tesla went wild.

A Robinhood platform user borrowed with credit card advances and home equity loans to blow up his account into >$800k in losses. It’s now becoming a regular occurrence to find articles investigating the phenomenon of day traders in the COVID lockdown era.

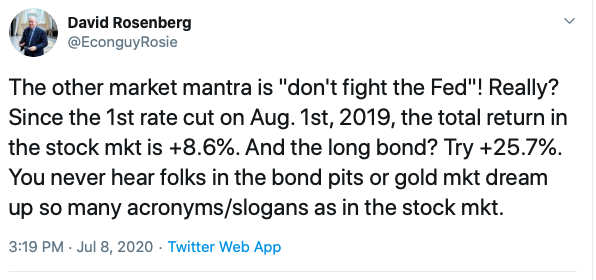

Despite all the hyperbole (“don’t fight the fed”), David Rosenberg notes how the long bond has performed relative to stocks since the fed reversed position and cut rates in August 2019.

Buffet went into hard assets with Berkshire’s purchase of Dominion’s assets. While energy has been shunned by most investors, the timing of this acquisition is a classic low value buy. It might pay off for investors to keep an eye out for energy players over the next while. I remember how hated they were during the last domination of the markets by technology plays. It isn’t to suggest we will see a massive commodity and energy rally similar to post-2004, but for those that like to buy unloved quality, you might not find anything more unloved than energy is today.

On the positive, gold continues to go up. So at least some things seem to make sense.