by Bane

This post was written on August 10, 2020

The data and numbers we have been inundated with since the COVID shutdown initiated in the UK has been dizzying. Today the UK produced GDP figures for Q2 2020 that show a 20% decline….for the quarter. On the same day the UK FTSE index climbed 2%, trending upwards as it surpasses the 50-day moving average.

Although not entirely unrelated, the S&P 500 nearly closed near an all-time high.

Now clearly markets are forward looking and economic stats are backward looking, but can you think of anytime in history where you have record breaking negative declines in GDP while all-time highs for shares are being hit? What a disconnect. That entails assumptions about one rapid recovery.

I ventured into Central London on a Saturday at the end of July. The weather was a tad rainy that day so I didn’t want to chalk the vacancy of the streets up entirely to the economic draught we are actually in. I decided to visit the Churchill Museum the following week, on its opening day. At the same time I decided to take a walk around the streets between Piccadilly and St. James Park. The weather out that day couldn’t have been more perfect. That combination of heat and cool that leaves you comfortable even if you are walking for hours. The kind of weather that makes London sparkle in the summer. So you could be assured that this is as busy as the area was going to get for shopping, sightseeing, eating and whatever other pleasures you can take in the heart of London on a glorious summer’s day.

Central London is the heartbeat of retail activity and buzz, particularly on a beautiful summer’s day. You have the major sights for tourists, food and drink for those in a party mood, parks for those in a relaxing mood and the best options for shopping in the city for those in a spending mood. All of this activity accounts for a large segment of the services’ economy, and more specifically retail. Retail sales equate to approximately 20% of UK GDP (as of 2011, and it is my understanding this would have been little changed by as late as 2019 – but I haven’t crunched the numbers to be accurate). We are hearing a lot about a “v-shaped recovery”, and the retail stats are trying to show this. Yet I can’t help but notice a disconnect in this as well. One that should have a stronger relationship than the stock market with the economy. It’s called what I see on the street compared with the data.

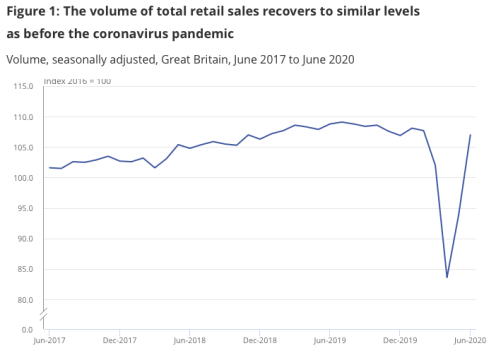

First retail sales were making a remarkable recovery as of June. Note that some of this is accounted for by online sales, however.

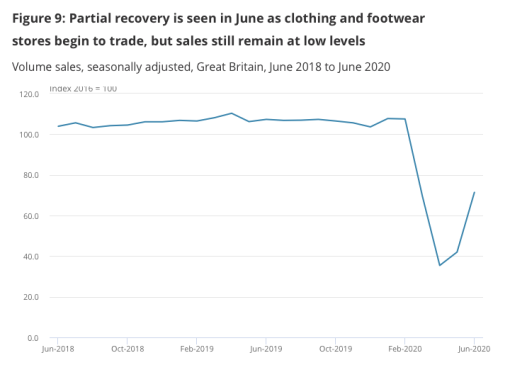

Yet when I was on Jermyn Street. I noticed 50% – 70% sales advertised at retailers such as PINK and Charles Tyrwhitt. The stores were empty. The street was empty. Even without tourists, the city has a population of almost 9 million. Surely these people would take advantage of a beautiful day, a re-opened economy and massive sales to take to shopping. Nope.

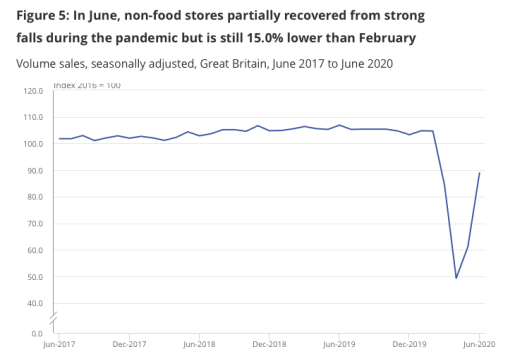

Even breaking down further to non-food stores would imply things should be better than they appear. At the very least this isn’t what a v-shape recovery would look like if I have the definition correct. That is things going straight back to normal?

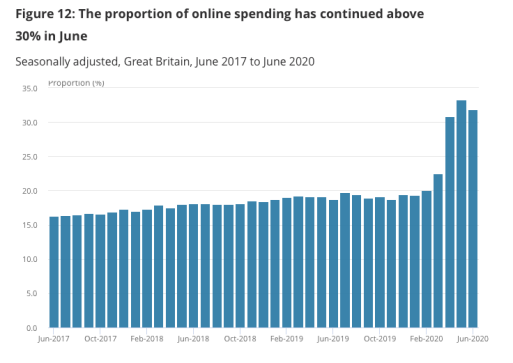

Although online spending has risen, the 10% increase in its proportion of retail sales isn’t enough and it appears to have maxed out.

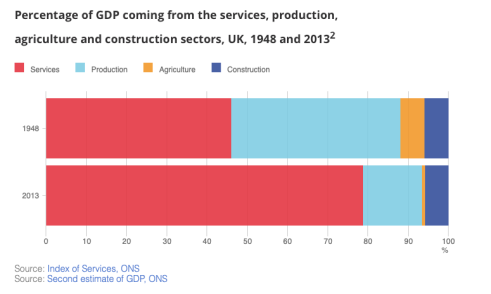

More importantly, the UK is a services’ economy. This is inclusive of retail, but also tourism – both important and positive contributors.

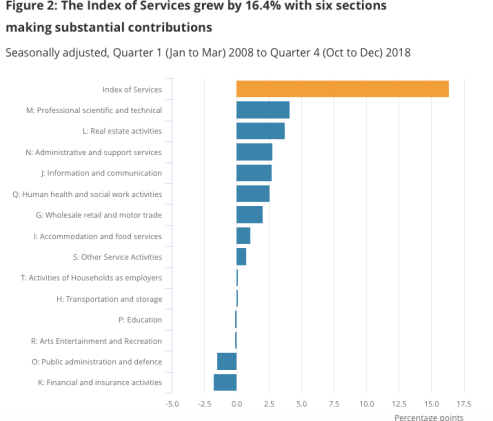

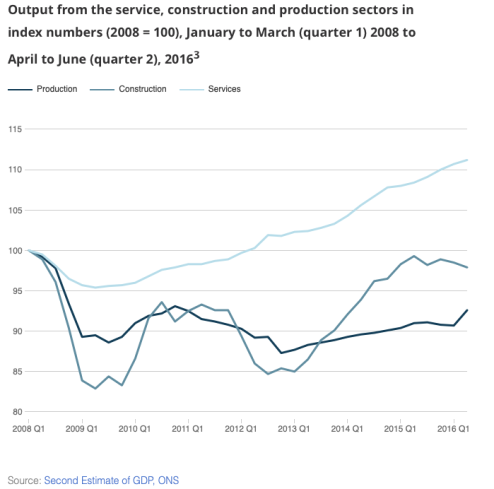

This has became more of the case after the financial crisis of 2008.

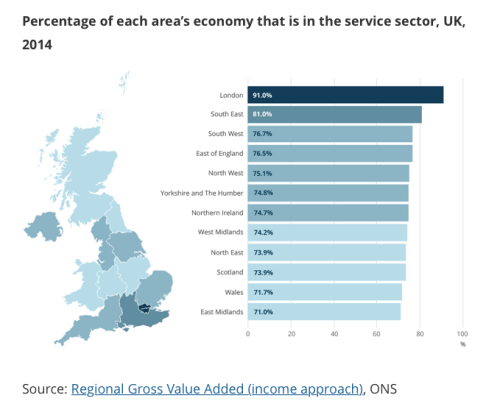

And lastly, signifying how important London is towards this services’ economy and, subsequently, UK GDP.

So let’s take a further look at what’s going on in Central London on the ground. There aren’t any international tourists, but perhaps a good portion of the UK’s 64 million people will take a day trip? London has many inhabitants themselves, only a bus ride away.

Let’s start with a tourists’ gem. I eagerly booked online to visit (re)opening day of the Churchill Museum and Cabinet War Rooms. These photos were taken in the early afternoon on the first weekend in August, a period of time when this museum should be lined up all day. Where you need to be 7 feet tall to get a good picture of an exhibit over the hordes of tourists. It was like having a private viewing. Even without the international tourists, you would think more Brits would have a keen interest in visiting this homage to their greatest leader of the 20th Century. Nope.

Let’s take a walk down The Mall to Buckingham Palace.

You could have walked down the middle of the road in the nude and nobody was there to stop you. How about Haymarket?

Pretty ghastly. Piccadilly?

Who wants to take a ride on a London City Tour bus?

Evidently nobody.

Major hotels such as the Sofitel were closed. Many shops were not open. I learned from the weekend before to pack a lunch, because there wasn’t much open for food and I need to eat. A lot. Those that were open, had little in the way of offerings. To be honest, it was good for me since I hate the tourists and the massive crowds. You would think more Londoners would share in this opportunity. While this might be good for my personal sanity, it doesn’t look good for the economy. If things are this empty in the middle of summer, how much better will they really get in the autumn?

The devil is in the details with the numbers. Headline figures can be misleading and despite showing a pick up in activity, I find it hard to believe even those figures are viable. It is a tangible disconnect. What we are experiencing and what is being reported just does not add up. It is hard to see, but here is a street near my neighbourhood where there are dozens of “For Sale” signs everywhere.

When an acquaintance of mine in the area asked people living near them why they are selling their flats, the response was they were “leaving London”. London as we have known it might be dead. If that’s the case, the UK is in for a painful period of transition. It is not “v-shaped”.