By Bane

This post was written on June 5, 2020

The date is May 29, 2020. The companies named include Amazon, Tesla, Microsoft and Alphabet. There are more, but these names stand out. What is it I am looking at? Investor Chronicle’s (IC) international bounce-back “must-buy” list for stocks – amid the economic clouds of Covid-19’s impact. The magazine further highlights Amazon in a key feature as a subset of this theme. In the same issue they reference the South Sea Company as the “original bubble”. The publication’s coinciding weekly podcast is also titled “Living in a bubble”. Yet curiously their writers (at least those on the podcast) shied away from applying the term “bubble” to today’s market – suggesting markets are not overvalued. It is interesting to make this claim while advertising America’s most trendy (and some of the most expensive shares) as “bounce-back” opportunities after the first wave of a pandemic. It is irrelevant whether the virus creates more economic constraints or disruption. Even before these events the markets were loopy and IC’s coverage itself is a soft indicator of familiar symptoms of financial mania.

Recently the IC has turned more towards America for its content. There is a sense of frustration with local investors and market watchers regarding the state of UK shares. Admitting its readership has wanted more content regarding American shares the IC has responded. Fair enough, but the sudden shift is helping encourage investors to follow the herd and try and “catch up” after a lost decade with the UK indices.

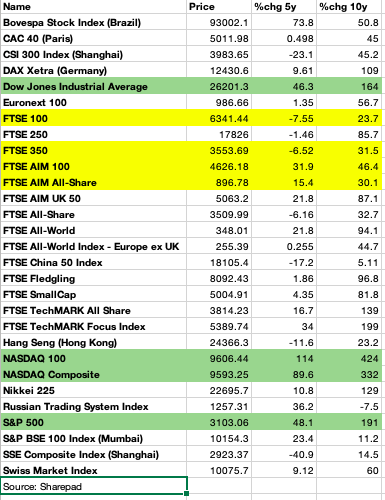

It is also a factor of greed. Looking at the above table the UK market has done barely ok in comparison with some other indices. It’s just the US names have done so much better. The performance of US indices has been weighted towards the heady returns of the FAANG shares. For the IC to encourage investors towards these names now makes me very skeptical of what kind of market we are in. Everything looks like a sure bet until it isn’t.

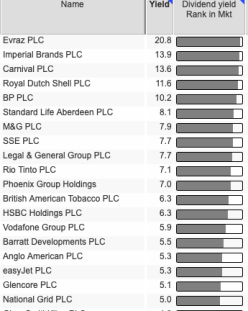

Even with the underperformance of UK shares, they are not immune from any financial downturn. The argument put forth in a portion of the IC’s podcast is that the stock market is not in a bubble and is cheap due to the level of dividend yields on the main UK index (~5% vs ~2% in 1999).* However, dividend yields are a lagging factor and are cut to bring yields in-line after earnings’ struggles, not before. Since share prices measure future earnings, or the expectation of future earnings, a high dividend yield in shares at the moment does not indicate “cheap” as much as potentially “dangerous”. Would you invest in any of the below with confidence today?

Source: Sharepad

Perhaps one or two, if that. So if the dividend yield within the index is being supported higher by the table’s troubled titans, I wouldn’t be relying on that metric as a signature of value. There’s also been a dramatic shift over the past decade for companies to focus on directing cash towards dividends and buybacks, as opposed to reinvestment. It is perhaps misleading to rely on such a metric when boardroom philosophy has a heavy influence over such a measure, rather than fundamentals, and that philosophy is different in context compared with 20 years ago.

The UK is full of value and income opportunities, not momentum or growth. As we know, low interest rates and Central Bank policy throughout the world has cheap money chasing growth and value has suffered. Hence Amazon and tech benefit. Been that way for a decade. Even still, low interest rates have resulted in a situation where there is enough money chasing income that the UK market has benefited from such inflows. So to assume the UK is absolved of any bubble because its dividend yield is high and the bulk of gains have been elsewhere is likely a mistake. Central Bank policy is unified among developed economies. The markets remain heavily globalised and any downturn in the US will have ripple effects globally. This is considerably troublesome if the entire world is now looking towards a narrow sect of the US for investment.

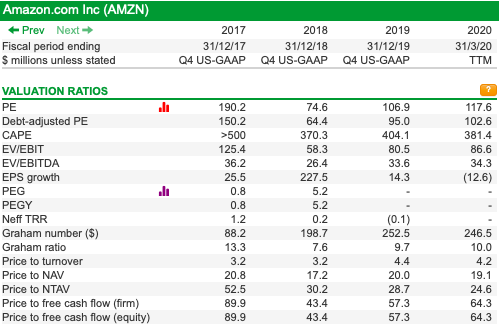

It is hard to come across any US fund that doesn’t have the likes of FAANG in their portfolio. If the managers don’t include them, they will underperform and will lose their jobs. Now the rest of the world is experiencing “fear of missing out” – UK included. IC isn’t alone in turning towards America, but for an overseas investment publication to make this transition now is a sign that perhaps things have gone too far. You can harp on the growth of Amazon’s high margin divisions and its ability to disrupt almost every industry under the sun, but that doesn’t automatically assume the price of the shares are justified.

Source: Sharepad

This is made worse when you factor in external influences, such as Central Bank policy and the unknown fuel it provides for outperforming shares. Then layer in the high volume of recent trading from retail platforms such as Robinhood in the US as retail investors, bored off their tree at home, are now diving in to the market full bore. I am not suggesting the IC shouldn’t be offering these ideas to UK investors, merely that it is perhaps a sign that we should stop and think about what is truly driving these shares. We know markets aren’t trading on fundamentals right now, but that doesn’t mean they never will or that fundamentals will catch up.

Are we in a bubble? Forget about trying to compare today with the signs of previous crises. We have engaged in a response to the 2008 crisis that is unprecedented. The response to Covid is also unprecedented. These are unprecedented times. Every crisis is different but there is a euphoria that is always present. Can we say with certainty that the interest in certain American shares is not a euphoria? When UK investors are shunning their own to buy up overseas shares at unimaginable valuations because of a perceived MOAT, are we certain that this massive influx of global buyers is not a herd mentality? Are we certain that if the entire market undergoes a collapse that these shares are recession-proof? That they won’t fall from these extreme valuations to more reasonable levels? Sure, businesses like Amazon and Netflix might be viable in a short-term lockdown but the lockdown itself isn’t a downturn in economic fundamentals. What if there is a fundamental or traditional economic recession? What if Central Bank policy can not provide the support to markets it has for the past ten years? What if a default domino effect impacts the entire global economy? It would appear there is little to gain and much to lose from where we sit today.

This is not to criticise Investor’s Chronicle. Indeed the UK needs valid financial publications as a country of such economic strength and financial history is lacking in this category when compared with America, or dare I say, even Canada. The magazine does a great job balancing education for the less market-versed, while also being useful for market veterans. The articles are informative, the writers are trying to help the private investor, they all know their stuff and they manage to put forth a lot of interesting themes in a weekly publication. The latter, in particular, is no easy task. Yet its focused shift towards American shares at this time can be seen as a warning that perhaps herd mentality is taking over. People are throwing in the towels and putting their money behind the FAANG shares, long after they have risen to heady valuations. These shares are what makes up most of the US market gains, and that should be a scary thing for long term investors. Even Jeremy Grantham is nervous, and if he is, we all ought to be.