by Bane

This article was written on June 21, 2020

Buffet vs Dave Portnoy?

The FT put out an article questioning Buffet’s approach in a contemporary market. What’s that saying….“when the tide goes out…”? This could be the longest dry spell of failure for value investors, with Buffet being the god of such an old fashioned art form of investing. Yet it would be the biggest home run of his career if the tide goes out and he’s left holding a bag of cash reported around $137 billion. What has this guy always been saying? Read all of his quotes and then if the market blows up with all of his cash, well, publications like the FT will look like fools. I could be wrong, but this guy has been right more than wrong and we have had unprecedented market interference by Central Banks since 2008, coincidentally when Buffet suddenly started getting “out of touch”. Just saying.

In the other corner making headlines are the retail traders. Led by this guy:

If you don’t know who Dave Portnoy is, particularly if you are outside of the US, look him up on Twitter. If nothing else, I’ve granted you some entertainment amid lockdown. He is the face of the Robinhood trader, which has experienced an increase in sign up largely thanks to sports betters with nothing else to give them dopamine hits. Robinhood, apparently, is coming to a laptop near you in the UK.

Corp Bonds Frenzy

I’m beginning to worry about Corporate Bonds. Macro guys like Raoul Pal have been warning about corporate debt for a while, but this got worse with Covid and people have suddenly discovered a new place for yield that isn’t as risky as shares. Or is it? I have long-dated corp bonds that have oscillated between being down 14% towards up 10%…like a yo-yo. Not just one time. Speaking of corporate bonds, you should really listen to what this guy has to say (if you aren’t already). It isn’t just Portnoy and his merry band of DraftKings followers driving this market to insane levels.

QE = Guarantee

The IC was back at it again in last week’s mag. One of their recent articles sounds too surely that QE will ensure a robust market rally akin to 2008, AKA QE1. The basis is that he missed out on QE benefit last time due to skepticism, but won’t miss out this time. Fool me once….... The writer believes earnings are set for a recovery in 2021. I can’t believe how many people say that as though it’s certainty. If you look around the world you see a lot of parts of society at a breaking point. There are a lot of threats other than Covid-19 that we seem to have forgotten about. Not to mention the economy wasn’t looking too great before this mess. Sure it’s such a low base right now but you have a couple unsuspecting bankruptcies and dominoes can begin to fall quickly.

Volatility

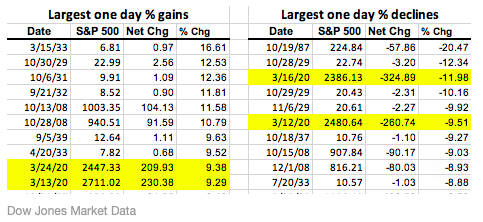

Jason Zweig over at the WSJ put out an interesting chart we should all marvel at.

Keep Calm And Keep up the Cliches

Lots of cliches this week. But when in crisis. One thing to remember that is never talked about enough is what sort of investments make sense for what sort of people. People are complex and have different tolerances for risk, different temperaments and most importantly of all, different timelines. Everyone needs a strategy. If you have a strategy then you should remain calm and stick to it. It may evolve as you age with experience, but don’t let any articles or analysts tell you what it should be. Discover for yourself. That said, those writing about stocks and investments should also place different recommendations for different buckets. Those buckets could be for those with high risk, low risk, long timelines or short timelines. It really does matter. Telling a 50 year old to pile into passive funds is a lot different than telling a 20 year old to do the same. It isn’t universal. We can discuss which are quality companies and which are not, but we should qualify those statements by categorising what an investment right now would mean.